When disagreements arise, we have a powerful new tool to help us seek truth together

I had a profound realization yesterday that shifted how I think about human conversation in the age of AI. It happened during a discussion where two people—myself and a good friend—found ourselves on opposite sides of a complex issue. In the past, this scenario would have played out predictably: we’d either rely on whoever claimed to have the most expertise, or we’d agree to “look it up later” and move on with the disagreement unresolved.

But something different happened this time. After our conversation ended without resolution, I turned to GPT for deeper exploration. Within minutes, I had access to comprehensive information that would have taken hours to research traditionally. More importantly, I had the kind of nuanced, multi-perspective analysis that neither of us could have provided alone.

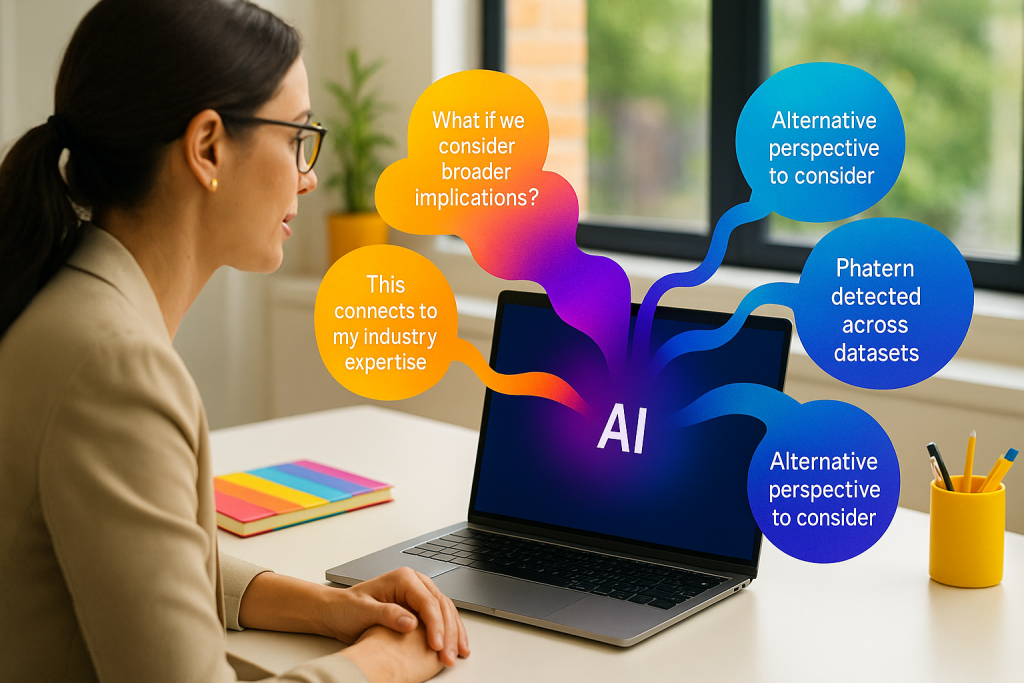

This experience sparked what I’m calling “AI in the Loop”—using artificial intelligence not to replace human conversation, but to enhance it in real-time.

The Old Model of Disagreement

Think about how we’ve traditionally handled disagreements about factual matters. When two people have different understandings of a situation, we typically fall back on one of these approaches:

The Authority Model: We defer to whoever seems most knowledgeable or confident, even if their expertise might be limited or biased.

The Research Promise: We agree to “look it up later” and research independently, often never actually following through or sharing what we find.

The Stalemate: We agree to disagree, leaving important questions unresolved and potentially missing opportunities for learning and growth.

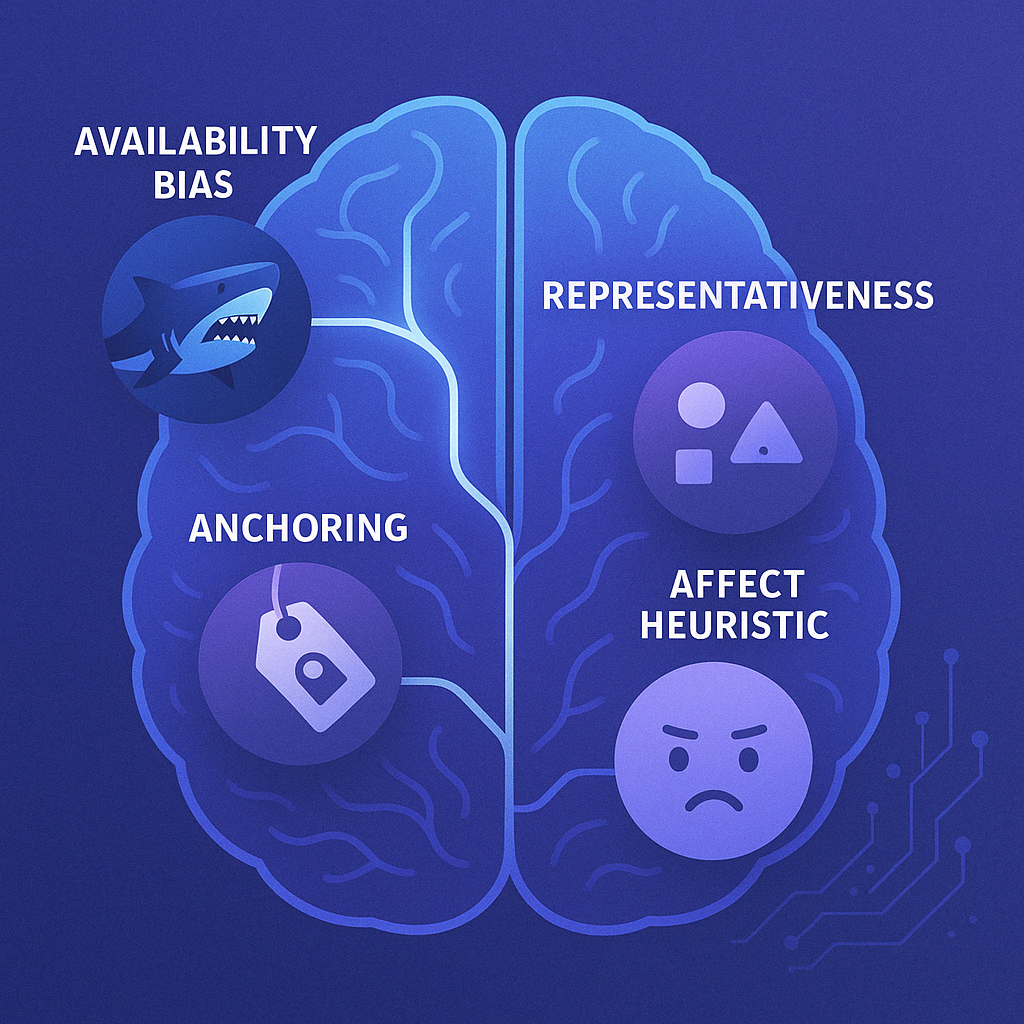

Each of these approaches has significant limitations. The authority model can reinforce existing biases and shut down productive inquiry. The research promise often leads to no resolution at all. The stalemate prevents the kind of collaborative truth-seeking that deepens understanding and relationships.

The AI in the Loop Alternative

What if, instead of these limiting patterns, we invited AI to join our conversation as a research partner? Not as the final authority, but as a tool for rapidly accessing diverse perspectives and comprehensive information?

Here’s how it might work:

During the Conversation: When we encounter a factual disagreement or need deeper information, we pause and engage AI together. “Let’s ask GPT to help us understand this better.”

Collaborative Inquiry: Both parties participate in questioning the AI, ensuring we’re exploring multiple angles and challenging potential biases in the responses.

Critical Thinking Applied: We use our human judgment to evaluate the AI’s responses, identifying gaps, biases, or areas that need further exploration.

Shared Resolution: We reach conclusions together, informed by comprehensive research but grounded in our collective critical thinking.

Why This Matters Now

This approach addresses a crucial challenge of our information age: the gap between the speed of conversation and the depth of research required for informed discussion. In the past, thorough research took time that most conversations couldn’t accommodate. Now, we can access comprehensive information within minutes—if we know how to use it effectively.

The key is maintaining our role as critical thinkers while leveraging AI’s research capabilities. In my experience yesterday, I had to push back against the AI’s initial responses, which showed clear bias. Through careful questioning and critical evaluation, I was able to get more accurate, nuanced information. This process required human judgment and expertise—AI provided the breadth, I provided the depth of analysis.

The Benefits of AI in the Loop

Enhanced Understanding: Access to multiple perspectives and comprehensive information in real-time.

Reduced Bias: When used thoughtfully, AI can help us move beyond our individual knowledge limitations and preconceptions.

Collaborative Learning: The process of questioning AI together can deepen relationships and shared understanding.

Practical Resolution: Conversations can move from opinion-based disagreement to evidence-informed discussion.

Skill Development: Regular practice with AI in the loop helps develop better critical thinking and information evaluation skills.

The Critical Thinking Requirement

This approach only works if we maintain our critical thinking skills. AI responses can contain biases, inaccuracies, or oversimplifications. The human role remains essential:

- Asking follow-up questions that reveal bias or gaps

- Challenging assumptions in AI responses

- Seeking multiple perspectives on complex issues

- Evaluating sources and reasoning

- Applying context and nuance that AI might miss

Practical Implementation

To make AI in the loop work effectively:

Set Clear Intentions: Establish that you’re seeking truth together, not trying to “win” the argument.

Share the Process: Both parties should participate in questioning the AI and evaluating responses.

Maintain Skepticism: Treat AI responses as starting points for investigation, not final answers.

Practice Critical Evaluation: Develop skills in identifying bias, gaps, and limitations in AI responses.

Focus on Learning: Approach the conversation as collaborative inquiry rather than debate.

The Broader Implications

AI in the loop represents a new model for human-AI collaboration that goes beyond simple automation. Instead of replacing human conversation, it enhances our capacity for informed discussion and collaborative truth-seeking.

This approach could transform how we handle disagreements in families, workplaces, and communities. Rather than relying on authority, avoiding difficult topics, or getting stuck in unproductive debates, we could engage in deeper, more informed conversations that actually resolve important questions.

As we navigate an era of rapid change and complex challenges, our ability to have productive conversations about difficult topics becomes increasingly important. AI in the loop offers a practical tool for upgrading the quality of human discourse—but only if we’re willing to engage our critical thinking skills and approach these conversations with genuine curiosity and openness to learning.

The future of human-AI collaboration isn’t about choosing between human wisdom and artificial intelligence. It’s about finding ways to combine our unique strengths to tackle challenges neither could handle alone. AI in the loop is just the beginning of what this partnership might look like in practice.

What conversations in your life could benefit from AI in the loop? The key is starting with curiosity rather than certainty, and maintaining our commitment to critical thinking even as we leverage AI’s research capabilities.